Introduction to Fund Setup in Singapore

September 9, 2021

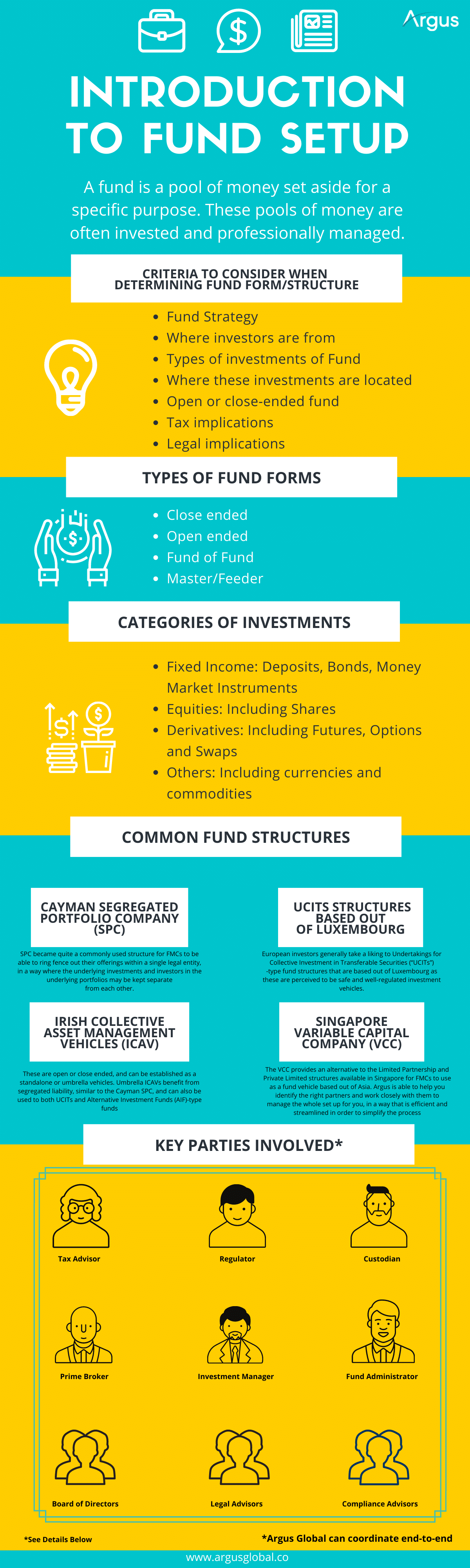

A fund is a pool of money set aside for a specific purpose. These pools of money are often invested and professionally managed.

Key Parties Involved:

- Tax Advisor

- Identify and put together the appropriate Fund structure in accordance to business model

- Understand tax incentives, substance requirements and disclosure requirements

- Regulator

- Authorises and approves fund structures where necessary

- Authorises and approves fund managers where necessary

- Custodian

- To ensure safe-keeping of investments

- Execute requests on movement of funds on request of manager

- Prime Broker

- Carry out securities lending, leveraged trade execution, and cash management

- Investment Manager

- Responsible for setting up the fund

- Often located in popular fund centres with good regulatory environment

- Manage portfolio investments and undertakes investment decisions

- Fund Administrator

- Calculation of Net Asset Value of fund

- Maintain and update portfolio of investments

- Pricing of assets

- Calculating fees and expenses

- Customer reporting

- Maintaining accounts and redemption/subscription process

- Board of Directors

- Ultimate responsibility for governance of fund

- Safeguarding interests of investors

- Responsible for approving fund documents and appointment of service providers

- Legal Advisors

- Draft investment management agreements

- Draft subscription agreements, shareholder agreements as well as Private Placement/Offering Memorandums

- Compliance Advisors (Argus Global Pte. Ltd.)

- Provide outsourced compliance support to the fund manager to fulfil MAS compliance requirements

- Provide ongoing compliance monitoring services to ensure fund manager is compliant with relevant rules and regulations

- Provide corporate secretarial support to the fund manager and the fund and ensure corporate compliance is maintained

How Can Argus (Now Waystone Compliance) Help

Argus (now Waystone Compliance) is able to assist in fund setup as well as the fund manager in the following manner:

- Provide input and advise on the regulatory requirements surrounding the specific type of entity that you should ideally be setting up in Singapore.

- Assist to set up the fund entity.

- Coordinate with other service providers such as lawyers and tax advisors to ensure all necessary legal agreements, tax exemptions are filed for.

Follow us on LinkedIn.