Payment Service Provider Licence Application – MAS issues amendments to its Guidelines

These changes are in line with the amendments made to the ‘Frequently Asked Questions’ within the Payment Services Act that was published on 19 April 2024.

We have summarized below the key changes that should be considered.

A.Legal opinion

- All new applicants are required to submit a legal opinion with their applications.

- Existing licensees who are intending to add on Digital Payment Token (“DPT”) services to their licence must also submit a legal opinion.

- Legal opinion must be issued by a law firm that has experience in advising on Payment Services Act in Singapore.

- Legal opinion must include a clear summary of the applicant’s proposed services and products that are required to be regulated in Singapore.

- MAS may require a second opinion if the first opinion is unclear.

B. External auditor’s independent assessment for new licence applications

- Applicants intending to offer DPT services are required to appoint a qualified independent external auditor and submit an independent assessment report from the auditor along with the application.

- Existing licensees applying to vary their licence to include DPT are also required to do the same.

- The report must be issued and signed off by the external auditor within the last three months from the date of the application submission.

- It is the responsibility of the applicant to ensure that the chosen external auditor is appropriately and suitably qualified to perform this review.

- MAS may request a second report should the first report be insufficient.

- Once the applicant receives the In-Principle Approval (“IPA”), it is required to appoint a qualified external auditor to perform an independent assessment of its policies, procedures and controls in the areas of technology and cyber security risks as part of its IPA condition.

C. Case-on-hold process

- MAS reserves the right to place a hold for six months on any application that is assessed to be insufficiently ready for review in these circumstances:

- Major corporate restructuring

- Substantial changes to key management

- Material variations to the business model/activities

- The applicant is responsible for ensuring the timely resolution of all changes and must provide this to MAS before the end of the assessment period. Failure to do so may result in the withdrawal of the application.

D. Changes to admission criteria

- MAS has clarified that it is the applicant that is responsible for ensuring that the directors, CEO, shareholders and employees meet the fit and proper criteria.

- When assessing whether they are fit and proper, MAS would also consider other factors such as conflicts of interest and time commitment constraints with regards to the relevant persons for the entity in Singapore.

E. Base capital

- MAS has clarified that, as a general rule, the base capital of the entity should be able to cover at least 6 to 12 months of the applicant’s operating expenses

- The applicant should also put in place an effective monitoring system to ensure that they can meet the threshold at all times.

F. Compliance requirements

- As stated previously, applicants may obtain compliance support from an independent and dedicated compliance team at group level, however, they must ensure that there is adequate oversight from the applicant’s senior management.

- MAS has clarified that with regards DPT, applicants are required to put in place an in-house compliance officer in Singapore due to the higher risk posed and the complexity of that business.

- MAS has also clarified that there should be appropriate governance in place to oversee compliance and AML/CFT issues. This can be gained by ensuring a compliance officer regularly reports compliance and AML/CFT issues to the board or board committee.

G. Technology risk management

- Licensees providing DPT services must comply with the Notice on Technology Risk Management [FSM – N13], with effect from 6 November 2024.

- All other licensees are to refer to the Guidelines on Risk Management Practices.

H. Rules of engagement

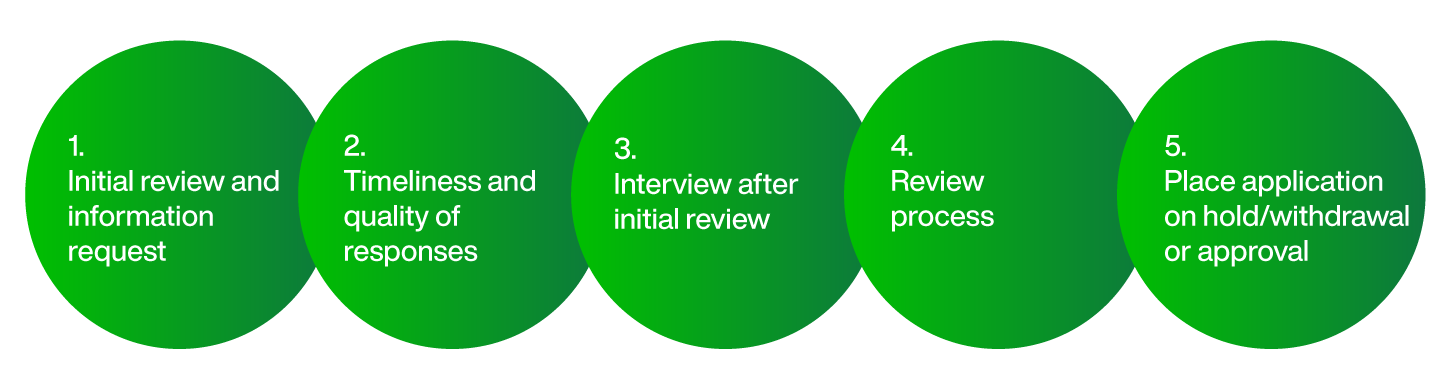

MAS has provided guidance on how applications will be processed:

- Initial review and information request

- The review process begins when a MAS case officer is assigned upon complete submission of information and documents requested.

- A case officer will reach out to the applicant on necessary next steps, which may include an opening meeting.

- Multiple rounds of requests for information and clarifications will be sent, depending on the completeness of the responses submitted by the applicant.

- Where submissions are found to be grossly incomplete or significantly deficient, MAS reserves the right to reject the application.

- Timeliness and quality of responses

- MAS will typically provide a deadline to respond and if the applicant fails to meet the deadline, MAS will deem the application to be withdrawn.

- If the applicant requires more time to respond, they should reach out to MAS in advance to request for an extension.

- Interview after initial review

- MAS will arrange an interview with the applicant’s key management personnel and/or the compliance officer.

- The interview is a key determining factor in MAS’ assessment of the application

- Consultants, external legal counsel, and other third parties are not permitted to attend the interview.

- If there are material changes to the application post-interview, MAS may schedule a second interview.

- Review process

- A MAS case officer will review the application based on a comprehensive assessment of the applicant.

- The case officer will review the application in this context and expect the applicant to conduct itself as if it were already a regulated financial institution.

- Place application on hold and withdrawal

- Any changes to the information provided after submission requires immediate notification to MAS.

- In the event of significant/major changes to the application, MAS reserves the right to put a hold on the application for a period of six months.

- It is the responsibility of the applicant to resolve and complete all necessary changes within this period in order to continue with the application. Failure to do so may mean the applicant would be required to withdraw and repeat the application.

How can Waystone Compliance Solutions help?

Our dedicated team of compliance professionals has extensive experience in navigating the complexities of regulatory compliance in Singapore. In light of these recent updates by MAS, Waystone is able to assist clients by providing the following services:

- supporting clients through the entire licence application process with MAS, including addressing MAS queries

- providing compliance policies and procedures that are required as part of the application process

- ongoing compliance services that support an in-house or group compliance team

- conducting internal audit and business continuity management audits

- providing assistance with enterprise wide risk assessments.

If you require more information on this topic, or would like to find out how this could impact your business, please reach out to your usual Waystone Compliance Solutions representative, or contact us below.