Singapore VCC – benefits and lifecycle

The VCC concept was part of the trend of creating vehicles for passport funds, such as AIFMD in Europe, the Open-End Fund Company in Hong Kong and Corporate Collective Investment Vehicle in Australia. The VCC makes Singapore comparable to other main jurisdictions such as the Cayman Islands, Dublin and Luxembourg.

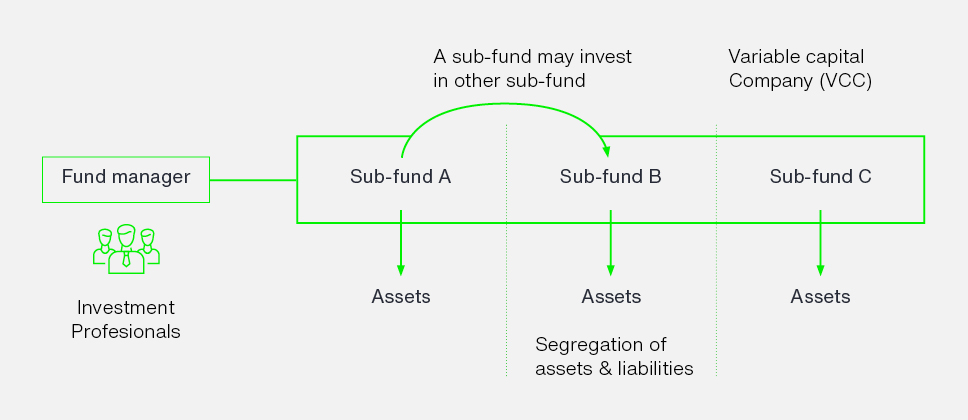

VCC Singapore offers several benefits and has a distinct lifecycle. We have set out an overview of these below:

Benefits of VCC Singapore

Flexible capital structure – the VCC allows for the creation of multiple share classes with different characteristics, such as voting rights, dividend preferences, and redemption rights. This flexibility attracts a wide range of investors with varying investment preferences.

Tax advantages – VCCs enjoy tax incentives, including exemption from Singapore’s goods and services tax (GST) on fund management services and no withholding tax on distributions made to non-resident investors.

Cost efficiency – VCCs benefit from economies of scale as they pool funds from multiple investors. This allows for cost sharing in areas such as compliance, administration, and audit fees, making it more cost-effective for fund managers and investors.

Enhanced fundraising – VCCs can be marketed to both retail and institutional investors, providing fund managers with a broader investor base. This enhances fundraising opportunities and widens the potential pool of capital.

Flexible investment strategies – VCCs can be structured to accommodate various investment strategies, including traditional asset classes such as equities and bonds, as well as alternative asset classes such as private equity, real estate, and hedge funds.

Lifecycle of a VCC

Incorporation – the lifecycle begins with the incorporation of the VCC in Singapore by submitting the necessary documents to the Accounting and Corporate Regulatory Authority (ACRA).

Fundraising – once incorporated, the VCC can start raising capital from investors. This involves marketing the VCC to potential investors and accepting subscriptions for shares in the company.

Investment management – the funds raised by the VCC are managed by the appointed fund manager. The fund manager makes investment decisions in line with the VCC’s stated investment objectives and strategies.

Reporting and compliance – VCCs are required to comply with regulatory reporting requirements, including financial statements, annual returns, and ongoing disclosures. They are also subject to periodic audits.

Redemption or liquidation – VCCs provide investors with the ability to redeem their shares based on the terms and conditions set out in the VCC’s constitution. Alternatively, the VCC may go through a liquidation process if it reaches the end of its planned lifecycle.

VCC services provided by Waystone

| Type of Activity | Scope of Services |

|---|---|

| Incorporation of VCC | Prepare and lodge all prescribed forms and requisite documents with the Accounting and Corporate Regulatory Authority (“ACRA”). |

| Assist with the relevant payments to ACRA. | |

| Company Secretarial Services 1 | Acting as named secretary in ACRA records. |

| Maintenance and safe keeping of the minutes and register books. | |

| Send email alerts in respect of ongoing compliance matters as applicable to the principal specific to the relevant obligations under the VCC Act. | |

| File the annual return with ACRA. | |

| Collate and validate all the documents as may be required by the Principal to file the MAS grant where relevant. | |

| Provision of AML Policy for VCC | The VCC is required to adhere to MAS’ requirements on AML/CFT – it is important to ensure that its AML/CFT policies and procedures adequately cover the applicable regulatory requirements and updates. Waystone will assist with drafting the client’s AML Policy for the VCC. |

| VCC Compliance Support | Provide regulatory updates to the client on AML/CFT notices, guidelines, relevant sanctions and significant Financial Action Task Force (FATF) changes.

Provide Customer Due Diligence (CDD) forms, to enable the client to perform due diligence and risk rate investors prior to onboarding and on an ongoing basis. Asist in the review of the identification and verification documents collected, completed CDD forms, and identify any gaps to be remediated. Assist with the review of the risk ratings assigned to investors and assess suitability of the risk rating assigned during initial onboarding and periodic review. Where required, assist in the provision of a file note to be documented to substantiate the risk ratings assigned by the client to the investors. Advise and review additional procedures to be undertaken by the client as part of enhanced due diligence, on investors who are ranked as high-risk customers. Advise on whether a simplified due diligence procedure can be adopted on any low risk customers and ensure the nature of simplified due diligence and reasons are well documented. Assist with the tracking and guidance of periodic due diligence due for the client. Provide a summary report on a quarterly basis to the client on AML/CFT work carried out. |

1 Our work will exclude onboarding of investors/subscribers as this will be supported by fund administrator who will maintain your register of investors/subscribers. Where notifications to ACRA requires nonstandard board resolutions, these would be provided by legal advisers. Where Annual General Meeting (AGM) documents to be provided by legal advisers.

To find out more about the Singapore VCC, please reach out to your usual Waystone representative or contact our team of compliance professionals below.