Timeline confirmed for Singapore to repeal Registered Fund Management Companies regime

To continue operating, existing RFMCs must transition to become Licensed Fund Management Companies (LFMCs) restricted to serving qualified investors, namely accredited investors, and institutional investors (A/I LFMCs), under the Capital Markets Services (CMS) framework by 30th June 2024.

To learn more about converting from RFMC to LFMC, review our guide here.

The events leading to repeal RFMC regime

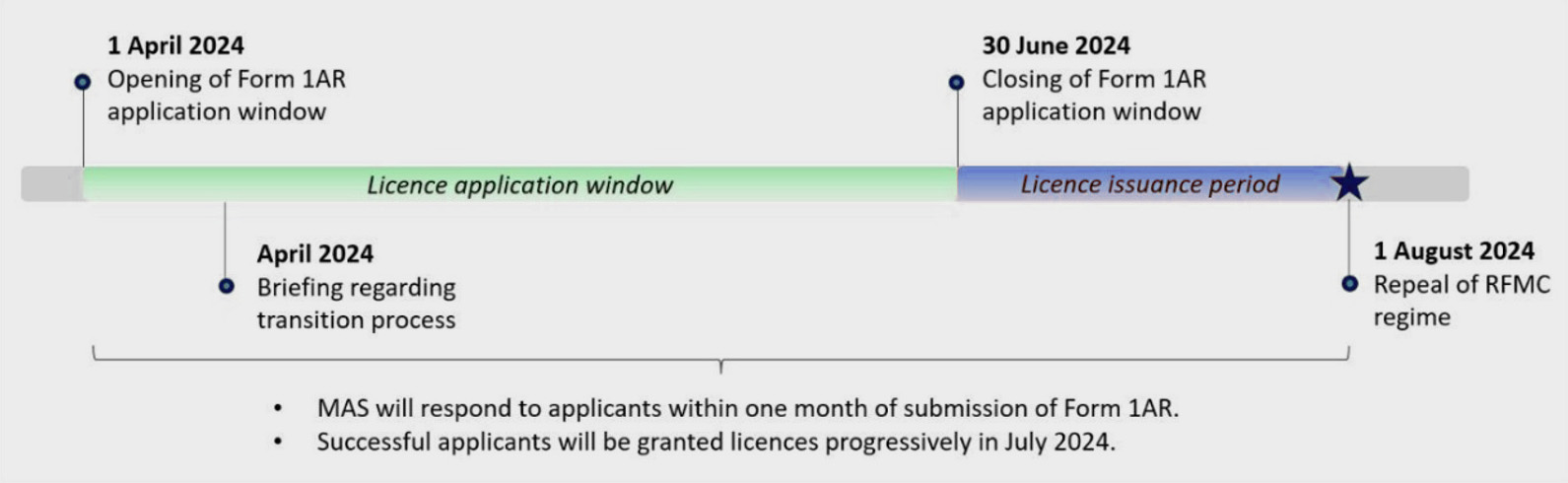

Below is a timeline of events leading up to repeal of RFMC regime:

Response to Consultation on Repeal of Regulatory Regime

Response to Consultation on Repeal of Regulatory Regime

Applying for an A/I LFMC License

- Application window: existing RFMCs can apply between 1st April and 30th June 2024 using Form 1AR available online

- Review process: MAS will inform applicants of their decision within one (1) month. Successful applicants can expect their CMS licenses by end July 2024. Current exempt representatives will become appointed representatives upon licensing.

Eligibility for A/I LFMC status

MAS will approve applications if the RFMC:

- Managed third-party investor assets in the past six months (except for RFMCs registered less than six months)

- Submits Form 1AR on time

- Provides supporting documents upon request by MAS

Continuity of operations

- RFMCs can continue functioning during the application process but must comply with existing regulations. Upon receiving a license, A/I LFMC regulations will apply immediately.

- You should familiarise yourself with these requirements beforehand. RFMCs with ongoing regulatory issues can still apply. However, approval doesn’t waive existing issues, and remediation will be required post-licensing.

Unsuccessful applications

- RFMCs inactive for the last six months will lose their registration and cannot manage funds after the repeal.

- There’s no appeal process for such entities.

Communication with investors

- Consider informing investors about your transition plans before the repeal.

- RFMCs without a CMS license by 1st August 2024 will no longer be authorised to manage funds. Therefore, continuing such activities might be a regulatory breach.

AUM cap and lifting procedures

- A new limit of S$250 million in assets under management (AUM) applies to newly licensed A/I LFMCs.

- MAS can review and potentially lift the AUM cap based on factors like:

- Regulatory compliance history

- Internal controls and risk management

- Board stability

- Business model and investment strategy changes

How can Waystone help?

Our APAC Compliance Solutions team understands the complexities of transitioning from an RFMC to an A/I LFMC. We offer a comprehensive suite of services to help you navigate the process smoothly and efficiently:

- Application process (Form 1AR and required documents if requested)

- Compliance manual review and updates to the A/I LFMC requirements

- Compliance monitoring programme suitable for A/I LFMC

- Preparation and submission of quarterly returns (Form 1, 2 and QIEF), scheduled in May 2024 and September 2024. The first quarterly returns to be submitted for successfully transitioned RFMCs will be the quarter ended September 2024

- Ongoing support on regulatory guidance and obligations post licensing

If you require any assistance or further information, please feel free to contact us.