Anti-greenwashing rule – not to be underestimated

One of the least discussed elements of the SDR consultation was the anti-greenwashing rule, which seemed to be an enhancement of the fair, clear and not misleading principle and rules. The Policy Statement then appeared to confirm that understanding, with a simple, two paragraph addition to the ESG Handbook.

However, the FCA also published a greenwashing guidance consultation paper, “GC23/3: Guidance on the anti-greenwashing rule”, that added considerable depth and complexity to the anti-greenwashing rule. On 23 April 2024, that guidance was published as finalised non‑handbook guidance (FG24/3). The guidance makes it clear how much of a paradigm shift there will be, and how high and deep the FCA’s expectations are. In this thought piece, we summarise the anti-greenwashing rule requirements and set out the steps that firms must take to comply with the rule.

What does the anti-greenwashing rule entail?

Rule ESG 4.3.1R of the FCA’s ESG Handbook, sets out the anti-greenwashing rule. While the majority of SDR applies to UK-based investment products, along with the investment managers and distributers of those products, the anti-greenwashing rule requires all authorised firms to ensure that sustainability-related claims are “fair, clear and not misleading”.

Furthermore, the rule applies to firms whether or not they are undertaking sustainability in-scope business, when they communicate with a client in the UK in relation to a product or service, or when communicating a financial promotion to, or approving a financial promotion for communication to, a person in the UK. Any reference to the sustainability characteristics of a product or service must be consistent with the sustainability characteristics of the product or service, and must be fair, clear and not misleading.

Guidelines for how sustainability references should be made

FG24/3 sets out four high-level guidelines for how sustainability references should be made:

- correct and capable of being substantiated

- clear and presented in a way that can be understood

- complete – they should not omit or hide important information and should consider the full life cycle of the product or service

- comparisons to other products or services are fair and meaningful.

In addition to claims relating to products or services, claims relating to entities will also fall in scope of the rule. Paragraph 2.32 of FG24/3 makes this clear, “Information about the firm itself may be considered part of the ‘representative picture’ in a decision-making process so it is important that these claims are also fair, clear and not misleading.”

Managing corporate statements in financial promotions

Financial promotions controls are typically focused on products, so firms will also need to assess and control any corporate statements that are made. Claims made through published policies, corporate social responsibility reports, thought pieces, social media, publication of social impact activities such as charity or community work, will all need to be reviewed for greenwashing, whether intentional or not. The inadvertent use of words, images or colours could also expose firms to the risk of greenwashing. For example, the use of a wind turbine related to a specific website page could lead readers to associate that image with the claims made on that page.

What should firms be doing now?

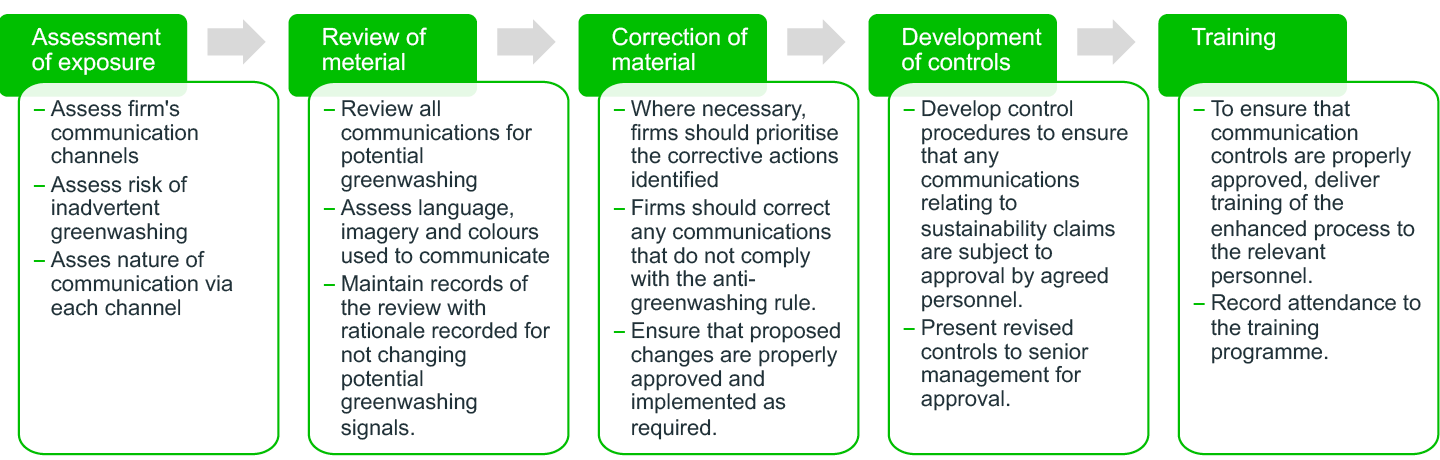

We have set out these chronological steps that firms should consider following in order to prepare for, and comply with, the anti-greenwashing rule:

The process above is an example of the type of steps that firms should be considering and should not be assumed to be the only approach taken in preparation for the anti-greenwashing rule. Complexity and proportionality are key elements when devising your approach to prepare for the forthcoming rule.

What challenges are firms facing?

Firms are at different stages in their preparation for the anti-greenwashing rule. As set out above, some firms have complex communication strategies, with many touch points with existing and prospective clients, whereas others will have a small number of exposure points.

Firms are experiencing two key challenges:

- lack of knowledge and expertise

- lack of available resource.

We have spoken with firms that are facing the challenge of ‘lack of knowledge and expertise’ amongst team members in relation to sustainability. Firms are reasonably familiar with preparing and reviewing financial promotions, where fair, clear and not misleading statements are made in relation to financial products or services, and the Consumer Duty has further embedded this in relation to all marketing, communications and documentation. The anti-greenwashing rule extends this process to include all sustainability claims, and many firms do not have the skillset to correctly assess their exposure to greenwashing.

Firms must therefore assess the competence of their team to produce, review and approve sustainability claims, taking into consideration the claims themselves and the channels through which they are communicated. Currently, we believe that there is a significant learning curve for firms and their employees to ascend.

With the deadline of 31 May 2024 drawing closer, the availability of resources to assess and amend such a wide range of communications, and to develop enhanced processes, is a significant challenge. The task should not be underestimated in terms of the time and people power required to ensure compliance with the anti-greenwashing rule.

Next steps

The FCA has made it clear through the introduction of the anti-greenwashing rule and the detail set out in FG24/3, that firms found to be purposely or inadvertently greenwashing will be subject to investigation and possibly enforcement action. In addition, the FCA will be using AI to scan the market for greenwashing indicators. Firms should therefore look at the process set out above and decide whether or not they have the availability and capability within their teams to adequately prepare for the implementation of the anti-greenwashing rule. Firms should not underestimate the challenge of compliance and should be aware of the potential consequences of not adequately preparing for this new regime.

To discuss any of the points raised in this brief summary, or to find out how Waystone Compliance Solutions can help with ESG, please contact us below.